michigan property tax rates by zip code

2020 TOTAL PROPERTY TAX RATES IN MICHIGAN Total Millage Industrial Personal IPP COUNTY. Please note that we can only estimate your property tax based on median property taxes in your area.

Median United States Property Taxes Statistics By State States With The Best Worst Real Estate Tax Rates

The citys homes have a median market value of 141100 and a median property.

. Michigan has 83 counties with median property taxes ranging from a high of 391300 in Washtenaw County to a low of 73900 in Luce County. 2022 Michigan local income taxes We have information on the local income tax rates in 22 localities in Michigan. The amount is based on the assessed value of your home and vary depending on your states property tax rate.

For a nationwide comparison of each states highest and lowest taxed counties see median property tax by state. The median property tax in Michigan is 214500 per year for a home worth the median value of 13220000. More than 180 school districts township counties and other governmental units in Michigan have tax requests on the May 2 2017 ballot.

Michigan tax forms are sourced from the Michigan income tax forms page and are updated on a yearly basis. You can look up your recent appraisal by filling out the form below. All groups and messages.

2022 Property Tax Calendar. City of Center Line Macomb County. The average effective property tax rate in Macomb County is 168.

Total taxable value. Lansing and has one of the highest property tax rates in the state of Michigan. Rate was 662 mills in Van Dyke school district.

To find detailed property tax statistics for any county in Michigan click the countys name in the data table above. Sales tax and use tax rate of zip code 48144 is located in lambertville city monroe county michigan state. Alger Au Train Twp 021010 AUTRAIN-ONOTA PUBLIC 254610 434610 194610 314610 254610 434610 MUNISING PUBLIC SCHOO 274610 454610 214610 334610 274610 454610 SUPERIOR CENTRAL SCH 310495 490495 250495 370495 310495 490495 Burt.

Homeowners have to pay these fees usually on a monthly basis in combination with their mortgage payments. Centerville Township Leelanau County 163. The average 2019 taxable value for residential parcels was 60984 which includes vacant lots and abandoned homes.

Start Your Homeowner Search Today. While the exact property tax rate you will pay for your properties is set by the local tax assessor you can estimate your yearly property tax burden by choosing the state and county in which your property is located and entering the approximate Fair Market Value of your property into the calculator. The 2022 state personal income tax brackets are updated from the Michigan and Tax Foundation data.

Rate is 173 mills for portion of township in Leland schools. Estimate Your Property Taxes Millage Rate Information. Information regarding personal property tax including forms exemptions and information for taxpayers and assessors regarding the Essential Services Assessment.

Go here for the Rocket Mortgage NMLS consumer access page. You can click the More Information link to. 48144 zip code sales tax and use tax rate lambertville monroe county michigan.

2021-2022 Statutory Tax Collection Distribution Calendar. You can now access estimates on property taxes by local unit and school district using 2020 millage rates. Michigan General Property Tax Act.

The tax data is broken down by zip code and additional locality information location population etc is also included. Detroit MI 48226-1906 NMLS 3030. The average effective rate including all parts of the.

West Bloomfield Township Oakland County. A sample of the 1153 Michigan state sales tax rates in our database is provided below. Our dataset includes all local sales tax jurisdictions in Michigan at state county city and district levels.

Counties in Michigan collect an average of 162 of a propertys assesed fair market value as property tax per year. United states number of homes. The median property tax in Michigan is 214500 per year based on a median home value of 13220000 and a median effective property tax rate of 162.

West Bloomfield Township had a total taxable value of 3561180050 in 2018 of which 89 is residential property. Tax amount varies by county. 1 Look Up County Property Records by Address 2 Get Owner Taxes Deeds Title.

Before the official 2022 Michigan income tax rates are released provisional 2022 tax rates are based on Michigans 2021 income tax brackets. United states number of homes. The Essential Services Assessment ESA is a state specific tax on eligible personal property owned by leased to or in the possession of an eligible claimant.

Ad Find Out the Market Value of Any Property and Past Sale Prices. The Michigan Treasury Property Tax Estimator page will experience possible downtime on Thursday from 3PM to 4PM due to scheduled maintenance. Rate for owner-occupied home in city of Center LineCenter Line school district.

Simply enter the SEV for future owners or the Taxable Value for current owners and select your county from the drop down list provided. Michigan property tax rates by zip code real estate. Such As Deeds Liens Property Tax More.

You will then be prompted to select your city village or township along. You can click on any city or county for more details including the nonresident income tax rate and tax forms. Michigan is ranked number eighteen out of the fifty states in order of the average amount of property taxes collected.

Glen Lake school district. Clair shores michigan 48081. In Sterling Heights the most populous city in the county mill rates on principal residences range from 3606 mills to 4313 mills.

Search Valuable Data On A Property. The median property tax in wayne county michigan is 2506 per year for a home. For more details about the property tax rates in any of Michigans counties choose the county from the interactive map or the list below.

To calculate the exact amount of property tax you will owe requires your propertys assessed value and the property tax rates based on your propertys address. The Millage Rate database and Property Tax Estimator allows individual and business taxpayers to estimate their current property taxes as well as compare their property taxes and millage rates with. The various Divisions of the Department of Treasury are guided by State statutes Administrative Rules Court cases Revenue Administrative Bureau Bulletins Property Tax Commission Bulletins and Letter Rulings.

The Local Community Stabilization Authority Act 2014 PA 86 MCL 1231341 to. Ad Get In-Depth Property Tax Data In Minutes. State Summary Tax Assessors.

The average combined rate of every zip code in michigan is 6. Nonhomestead rate is 314 mills. 4738 Willow Bend Rd Oscoda MI 48750.

This link will provide information on ESA who must pay ESA and how to file a statement and remit payment.

Michigan Sales Tax Small Business Guide Truic

States With Highest And Lowest Sales Tax Rates

Upstate Ny Has Some Of The Highest Property Tax Rates In The Nation

Wisconsin Property Tax Calculator Smartasset

Tax Bill Information Macomb Mi

Michigan Property Tax H R Block

Upstate Ny Has Some Of The Highest Property Tax Rates In The Nation

2022 Best Places To Buy A House In Washtenaw County Mi Niche

How To Calculate Michigan Property Taxes On Your Investment Properties

50 Communities With Michigan S Highest Property Tax Rates Mlive Com

Millage Rates And Real Estate Property Taxes For Oakland County Michigan

Harris County Tx Property Tax Calculator Smartasset

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

Livonia Michigan Property Taxes

50 Communities With Michigan S Highest Property Tax Rates Mlive Com

Will Michigan Lower Its Tax Rates Here S How We Compare To Other States Mlive Com

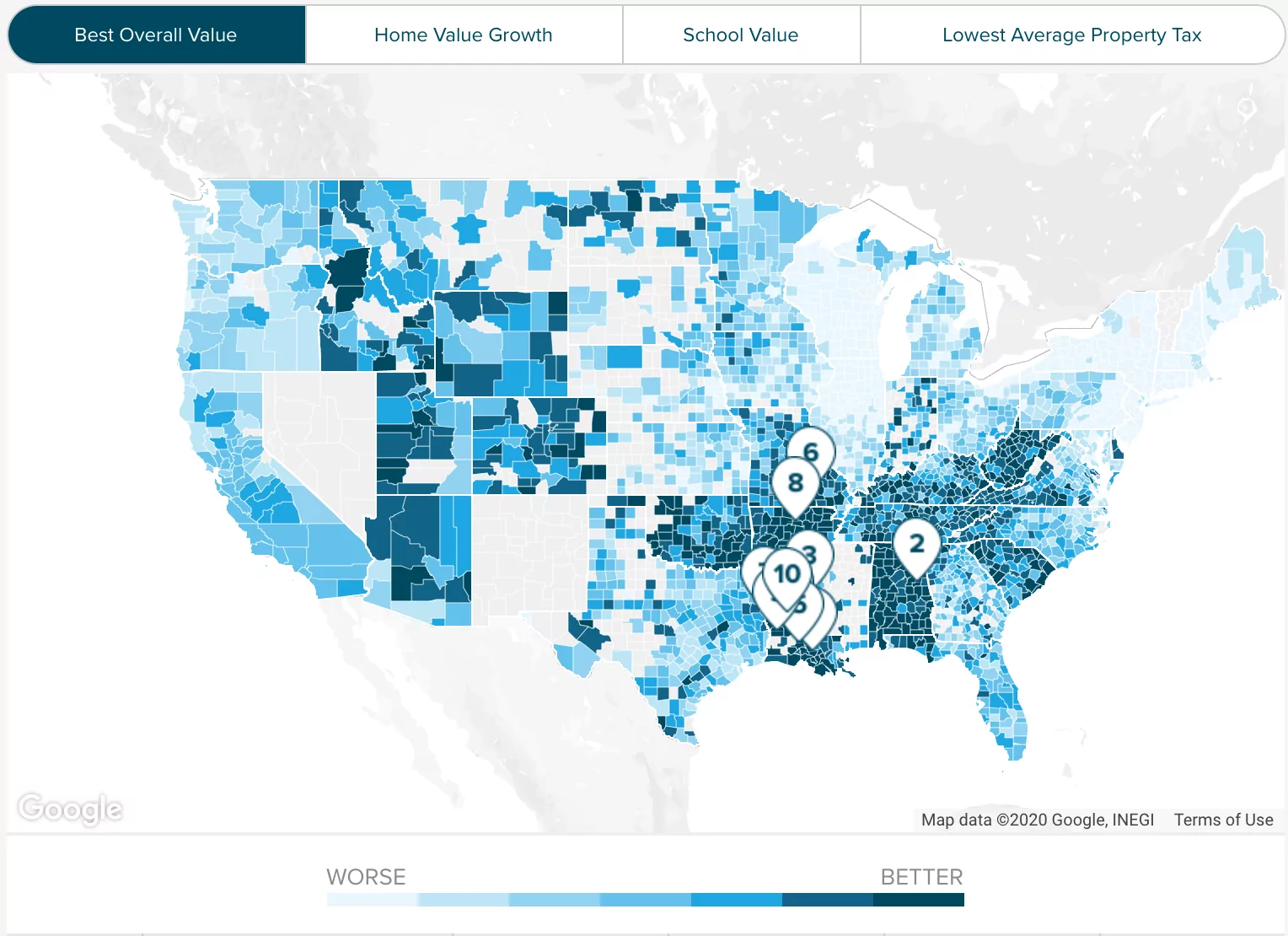

Property Taxes By State County Lowest Property Taxes In The Us Mapped